Compare Prequalified vs. Pre-Approved: What's the Difference?

Susan Kelly

Aug 19, 2022

Introduction

Here you’ll learn about prequalified vs. pre-approved: what's the difference? Pre-qualification is just the first step. It gives you a rough idea of the magnitude of the loan you might be qualified for. The second step is getting pre-approved, which is a commitment to provide you with a mortgage if you satisfy specific requirements. Pre-qualification involves using customer information. Preapproval is verified customer data, similar to a credit report. Pre-qualification and preapproval are distinct processes where a lender verifies your information to determine your loan limitations.

They are very distinct, even if they seem to be similar. Pre-qualification cost projections are based on the applicant's data. Typically, they don't look into your income, credit, or employment history. A mortgage loan needs to be validated before it can be pre-approved. Lenders typically review tax returns, bank accounts, and pay stubs before deciding whether or not to extend credit. When placing an offer on a house, having a preapproval puts you ahead of both prequalified and unapproved purchasers.

What Does Prequalified Mean?

When you are prequalified for a loan or credit card, the lender has conducted some initial research to decide whether they are willing to work with you. The customer commences the process by completing the application in the case of a loan or credit card pre-qualification. The pre-qualification criteria change based on the circumstances. It can be essential to disclose primary financial data, such as yearly income, housing payments, and savings amounts. Depending on the pre-qualification, a lender might run a soft credit inquiry. This kind of inquiry does not affect your credit ratings. Once you have been prequalified, you can apply and proceed with the rest of the screening process.

Following the review, you might be required to provide actual data rather than estimations and consent to a hard credit inquiry, which might affect your credit ratings. Pre-qualification is not a promise of ultimate approval. Although submitting a direct application for pre-qualification isn't always essential, it is usually preferred if you can politely request it in advance (or without an inquiry). If your application is turned down at this point, you are free to continue without having to go through a more extensive review.

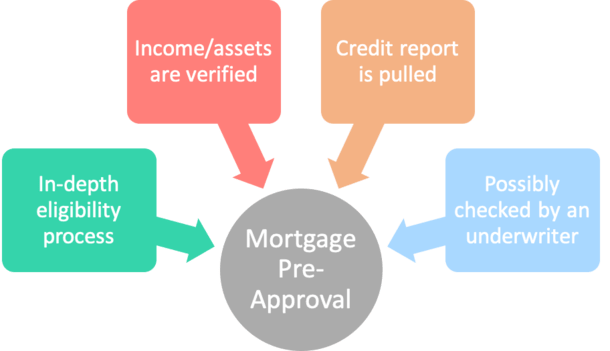

What is Mortgage Preapproval?

A mortgage loan preapproval is a more trustworthy sign of future loan approval. Your offer will stand out from the competition if you make the extra efforts to verify your income and credit score. Checking one's credit report and confirming one's income are necessary for obtaining preapproval. W-2s, 1099s, and tax returns are some examples. Your estimated borrowing capacity is given based on your income and other financial commitments in a preapproval. You will be given a detailed breakdown of every aspect of your loan, including interest rates, monthly payments, fees, and the total amount you can borrow.

The bank has already given you the go-ahead to purchase. Only the lender's acceptance of the property you want to buy will determine if your mortgage application is approved. By having a preapproval letter in your possession, you may be able to avoid losing out on the home of your dreams and increase your chances of getting a mortgage acceptance. Pre-approved offers are more likely to be taken seriously by sellers and agents than prequalified ones.

Do Preapproval and Prequalification Offers Impact Credit Score?

Your credit score won't change because a credit check used for pre-qualification or preapproval frequently generates a soft inquiry. While school loans and credit cards don't affect your credit score, applications for a car loan or a mortgage may. Fortunately, even if this does occur, the effects are usually minor and transient (a matter of months at most). Credit scoring algorithms regard all complex queries made within 14 days as submitted concurrently (some models allow up to 45 days) if you wish to refinance a car or house loan. You might be able to prevent significant harm to your credit score if you rapidly search for alternative loan arrangements.

What's the Difference Between Preapproval vs. Prequalification?

Before delivering a more precise loan estimate, the lender thoroughly reviews your credit and financial situation at the preapproval stage of the loan application process. In pre-qualification, assertions made by applicants are taken as accurate without further inquiry.

Conclusion

Unlike the pre-qualification process, preapproval for a mortgage loan does not depend on the borrower's ability to honestly and accurately describe their financial condition. Agents and homeowners will have more faith in you as a potential home buyer if you undergo this additional verification procedure. Preapprovals are more challenging to obtain than pre-qualifications, but they are worth the effort because they are more precise, comprehensive, and prepare you for the home-buying process.