How Does A Limited Liability Company Pay Income Tax?

Triston Martin

Nov 07, 2022

In all 50 states, LLCs are legally recognized as an excellent corporate structure. How Do Taxes Work for LLCs (referred to as "members" in an LLC) have limited liability when they form one and are subject to their tax rates. Payment of income taxes by an LLC may be handled in various ways, depending on factors such as the number of members in the LLC and whether or not the LLC has chosen to be taxed as a corporation or partnership. For tax reasons, an LLC is not recognized by the IRS. So, how does a limited liability company file its tax returns?

How Exactly Do LLCs Get Taxed?

An LLC is generally classified as a pass-through business to pay federal income taxes. Thus, the LLC is exempt from paying taxes on its profits. Members of an LLC are responsible for paying taxes on their proportionate part of the business's earnings. State or municipal governments may impose additional LLC taxes. Instead of paying taxes on a pass-through basis, LLC members might elect to have their business treated as a corporation.

LLCs must pay a variety of taxes. These levies are collected by federal, state, and municipal governments. Earnings distributed to LLC members are subject to income and self-employment tax at the appropriate rates. You may also have to pay payroll taxes, including sales taxes, depending on the merchandise you sell and the number of employees you have. Another wrinkle is that an LLC may be taxed as a different corporate entity if so chooses.

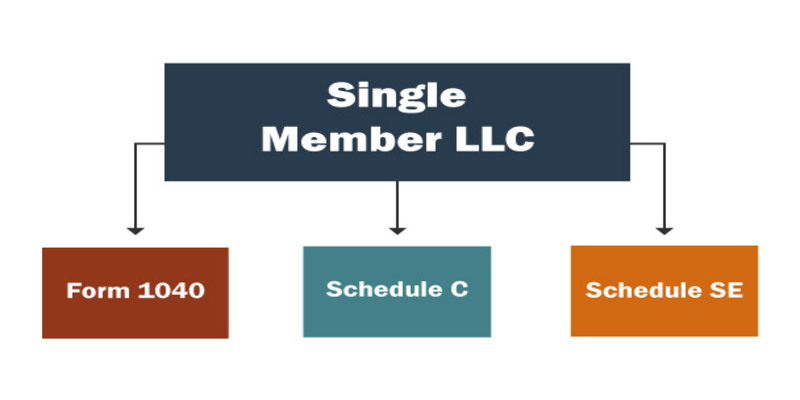

How To Pay Income Taxes For A Single-Member LLC

A single-member LLC is treated as a disregarded entity by the IRS. To rephrase, the LLC is not treated as a distinct entity from the owner for tax reasons. Because it is a sole proprietorship for tax purposes, an LLC that meets the requirements to be "disregarded" is not subject to corporate taxation. In other words, a Schedule C is prepared to detail the LLC's revenues and expenses, and the net income is then transferred to the owner's tax return (Form 1040 or 1040-SR). An LLC can be formed by filing a Certificate of Incorporation (or perhaps a similar application) with the state where the business will operate.

Income Taxes For Single-Member Limited Liability Companies

An LLC with a single member is considered a disregarded company by default for income tax purposes. Certified Public Accountant (CPA) Vincent Porter of MyTexasCPA explains that if an LLC is "a disregarded entity," it does not need to submit its tax return to record its revenue and expenditures. As the only member of an LLC, you will file your tax return as little more than a sole proprietor and document your company income and expenses on Schedule C of Form 1040. If the LLC makes a profit after accounting for all its operating costs, the owner will be responsible for paying taxes to the Internal Revenue Service at their marginal rate. Those losses may be deducted from the manager's income if the LLC posts a loss for the year.

Tax On Self-Employment And LLC Owners

LLC members often get compensation for the company's activities. This money is taxable as self-employment earnings (Social Security and Medicare). A company owner's tax liability is determined by taking their annual net income and plugging it into Schedule SE. Earnings from renting real estate (Box 2 of Schedule E) are not subjected to self-employment tax, so you may add this amount to the rest of your income with your taxes without worrying about a separate self-employment tax. Because it is not an active company, money earned by LLC members from it may be limited under the passive loss restrictions.

Conclusion

Tax considerations should be given top priority when selecting a business organization. Depending on the kind of company organization you choose, you may have to pay more or less in taxes. The limited liability company (LLC) seems to be a business structure recognized by the state that shields its owners from personal responsibility. Unlike corporations, LLCs are treated not as independent tax entities but as "pass-through entities" by the Internal Revenue Service. The LLC's gains and losses are "passed through" towards the owners (called members) and included in their tax returns. While limited liability companies are exempt from federal income taxes, certain states charge yearly LLC taxes.