What Are The Most Important Things You Should Remember About Your Credit Score?

Triston Martin

Nov 08, 2022

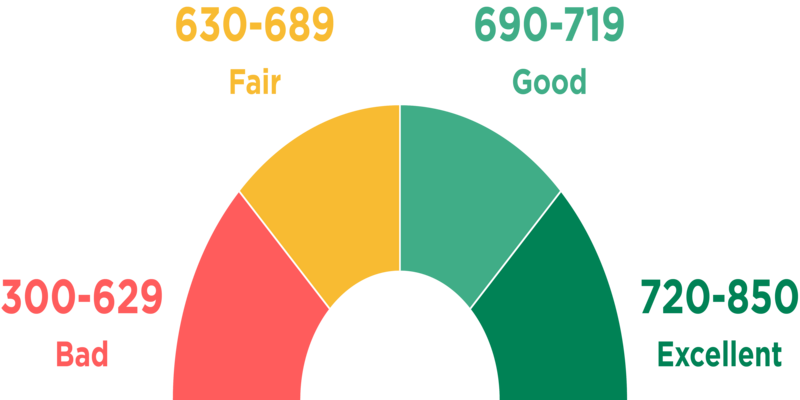

One's creditworthiness is measured by a three-digit number called the credit score. Lenders use credit scores to grant loans and credit cards and determine interest rates and know What Is a Credit Score. A customer's creditworthiness is shown by a numeric value, often between 300 and 850, that reflects the consumer's payment history and new credit inquiries. Loan providers will have a more favorable impression of an applicant with a higher credit score. The number of active accounts, your total amount of debt, overall monthly payments, and some other credit history are the foundation for a credit score. Lenders use credit scores to determine how likely a borrower is to meet their loan repayment obligations on time. At the same time, there are several credit reporting agencies in operation in the United States, Suntrust.

What Exactly Is A Credit Score?

The normal range for credit scores is 300 to 850. Credit scores of 670 and above are deemed "good" by FICO, the leading source of credit ratings. If your credit score is good, you will have a greater chance of getting loans and lower interest rates. Fair Isaac Company (FICO) but instead VantageScore Technologies (VantageScore) seem to be the two most prominent providers of credit scores. The Fair Isaac Corporation developed the scoring methodology used in FICO scores. The intellectual property for VantageScore is owned by a separate firm called VantageScore Solutions. VantageScore Technologies is a company that uses a scoring methodology co-created by the three main credit agencies (Experian, TransUnion, and Equifax).

Credit Scores: How They Work

Credit scores may be generated automatically via a procedure facilitated by FICO and VantageScore's scoring algorithms. If lenders didn't possess access to credit scores, companies would have to invest substantial time and money reading through each applicant's whole credit record. The person reviewing your application may also fail to see anything crucial in your credit report and otherwise misjudge the gravity of a certain item. Credit ratings make it much easier for prospective lenders to evaluate borrower's creditworthiness. After making payments and receiving data from collectors, your credit score might improve. Monthly fluctuations in your results are possible based on the variables mentioned earlier. The credit score you get may be somewhat different depending on what credit agency you use. Credit reporting companies are not obligated to exchange much of their data with one another, and they may each have somewhat different sets of information.

Credit Score Types

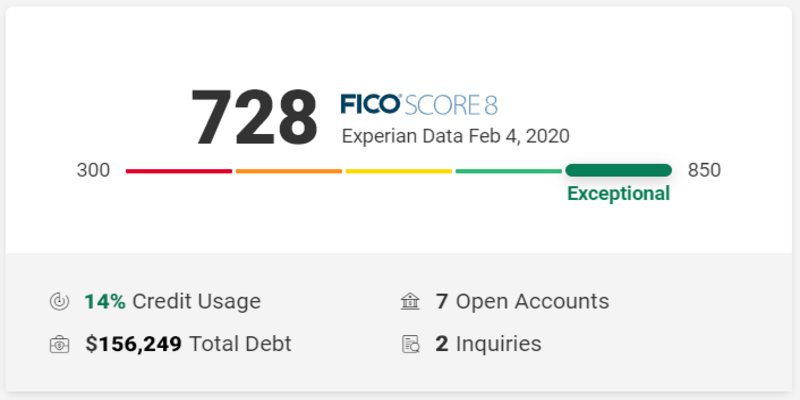

Different credit ratings may be used for different kinds of loans. FICO, for instance, has distinct ratings for auto loans, mortgages, and credit cards. The particular model utilized may influence your score, and both FICO and VantageScore continually improve their models. Though FICO Score 8 is still widely used, the newest version of the FICO model seems to be the FICO Score 9. VantageScore 4.0 is the current and most up-to-date version. Unpaid medical expenses are treated differently than other forms of debt in FICO 9.

How Can You Raise Your Credit Score?

While FICO and VantageScore may not disclose their algorithms' inner workings, they provide recommendations as to which aspects of credit history are most significant. Always try to pay your loans on time since this is the single most influential element in determining your credit score across all scoring models. It's no surprise that somehow a history of late payments would lower a person's credit score, given that the purpose of credit ratings is to anticipate whether or not payments will be made on time.

How Can You Find Out What My Credit Score Is?

Checking your credit report is simple, albeit there may be a price involved. Your credit scores may also be available from the following:

- Credit card companies may sometimes deliver free credit ratings to their consumers. Find out whether the credit card providers you already use offer rewards programs.

- You may inquire with the lender about your credit score during loan approval.

- To help you find sites that may provide easy accessibility access to your VantageScore, VantageScore keeps a list of partner sites.

- Credit scores from FICO may be purchased directly from the FICO website.

Conclusion

Repayment history, loan kinds, credit history duration, and overall debt are all considered when determining a person's credit score. Credit usage, or the proportion of available credit being utilized, is one factor in determining a credit score. Closing an inactive credit account may harm credit scores and should be considered carefully. A credit score uses data from your credit report to provide a three-digit number that reflects your creditworthiness. Scoring between 670 to 800 is often regarded as "good," if not "outstanding." Most scores fall somewhere in this range.FICO but instead VantageScore are the two main methods used to determine creditworthiness. Better interest rates but instead access to more credit are the consequences of a higher credit score.